Tax Office

Overview

Tax collection is one of the oldest duties administered by the office of Sheriff. This responsibility is a relic of the feudal bureaucracy established in the Medieval period by the English monarchy. The “Reeve” was appointed by the monarch to administer the laws of the “Shire” (which is equivalent to our system of county designations). Over time the designation Shire-Reeve became the word Sheriff. From this beginning, the modern day office of sheriff expanded into a multi-faceted organization responsible for law enforcement, tax collection, civil process, and a host of court-ordered monitoring and alternative sentencing programs.

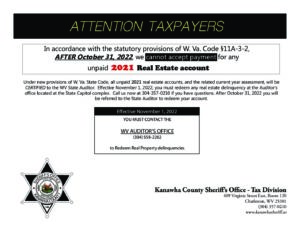

Under the provision of West Virginia State Code §7-5-1, the sheriff is the ex officio county treasurer. In this capacity, the sheriff is responsible for the collection of all revenue and disbursement of all monies due from the county treasury. The Tax Division is the branch of the sheriff’s office charged with collecting and disbursing funds due to and from the county. In addition to this duty, the Tax Division is also responsible for overseeing Conservatorship and Estate administration appointments.

Collections

The Tax Division employs 29 Tax Deputies, including the Chief, who operate and administer the duties of this office. Each year in July, the Tax Division prepares and mails approximately 95,000 personal property tax tickets and 100,000 real estate tax tickets. In 2012, the revenue generated by these ad valorem taxes is equal to $167,603,350. This money is distributed monthly to the County Commission, State of West Virginia, Kanawha Rapid Transit (KRT), Kanawha County Emergency Ambulance Authority (KCEAA), Public Safety Grant Committee, Kanawha County School Board, and all of the County’s local municipalities. Annual revenue from all sources totals $207,927,708.

In addition to the main office located in the old Courthouse, we maintain five (5) detachment locations throughout the county. The detachments are located in Cross Lanes, Sissonville, Elkview, Jefferson, and Quincy. Please see Locations for directions to these offices.

Fiduciary Responsibilities

In West Virginia, the Sheriff is appointed as conservator and/or estate administrator as a last resort for individuals who have no surviving family or no one else capable of providing them assistance, and in some circumstances wherein there is a dispute over probate. On average, we actively administer approximately 60 conservatorships and 25 estates.

Charleston hours: M – F: 8:00am-5:00pm

All others locations: M-TH: 8:00am-4:00pm, F: 9:00am-4:00pm and closed for lunch from 1:00-2:00pm daily

Tax Division: 304-357-0210 / fax 304-357-0291

Cross Lanes Detachment: 304-776-7564

Elkview Detachment: 304-965-7074

Quincy Detachment: 304-595-6470

Sissonville Detachment: 304-984-0006

St. Albans Detachment: 304-722-4911